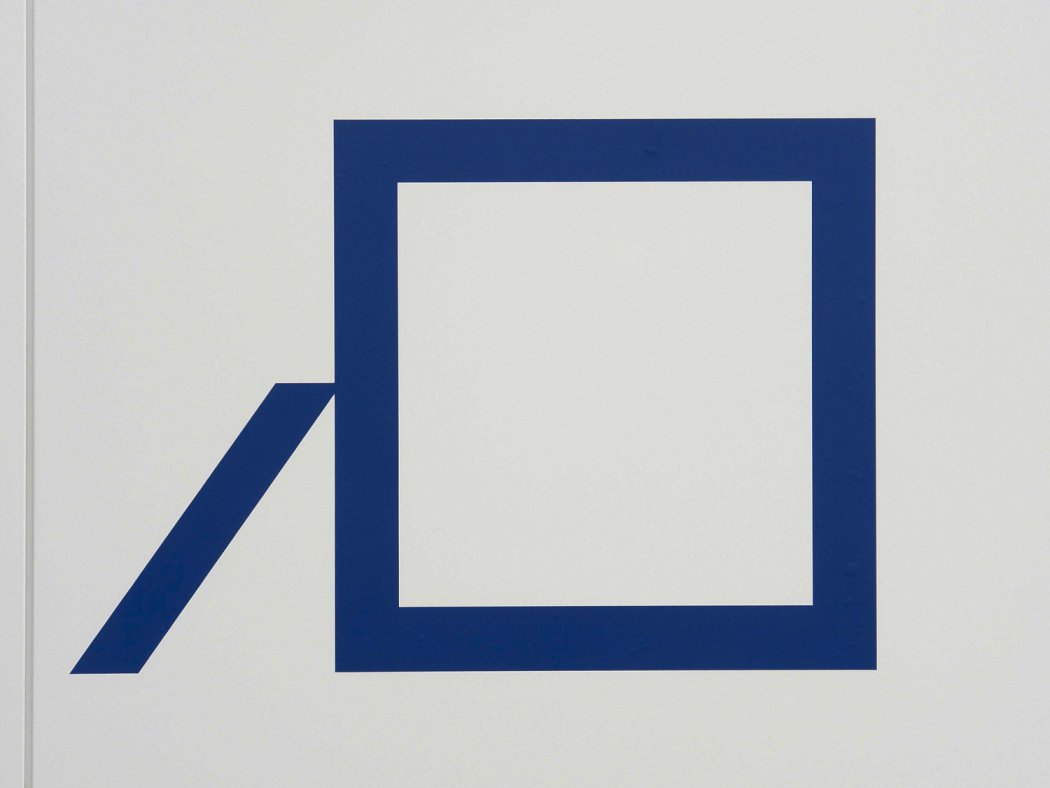

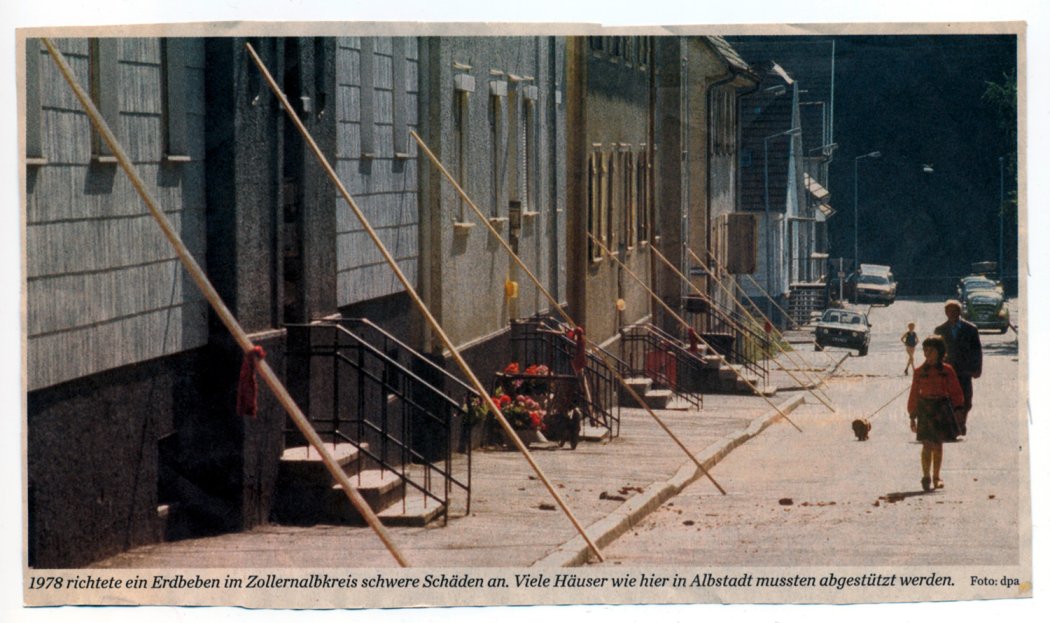

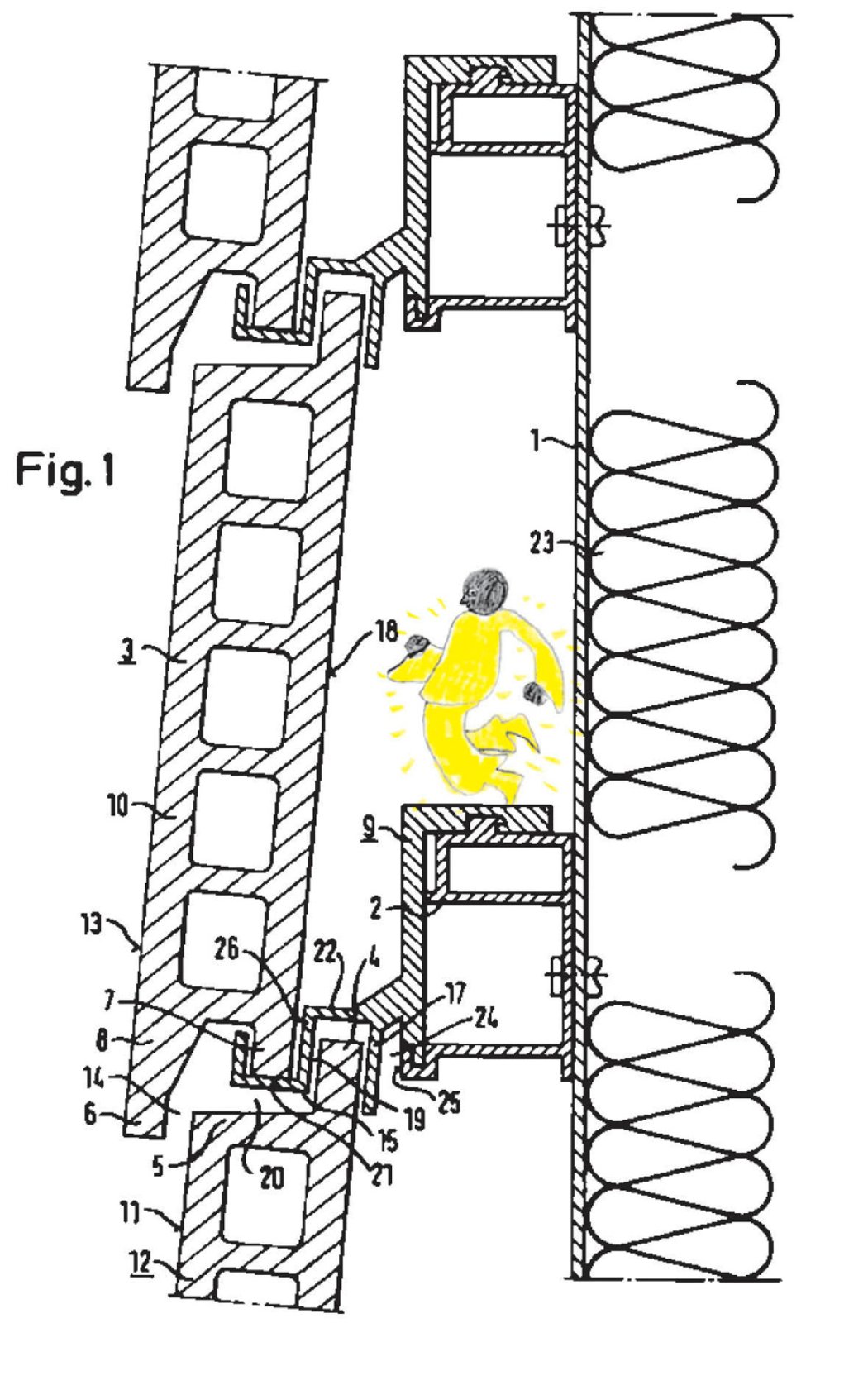

A support construction reveals the dilapidated state of a building – a Deutsche Bank branch in Mannheim – that is considered safe in terms of statics. Up to now, it has only been possible to build a model in the scale of 1:5.

Background

I

Every building is considered safe provided its collapse can be ruled out by a probability of 1:1 million. In 1912, Lloyd’s underwriters insured the Titanic passenger liner against this very possibility – namely, that the ocean liner might be shipwrecked upon colliding with an iceberg.

One should always assume that spontaneous changes in a planned series of events can turn into an uncontrollable causal chain. If nothing is happening, that’s when we should watch out!

→ All counterparts are inevitable.

II

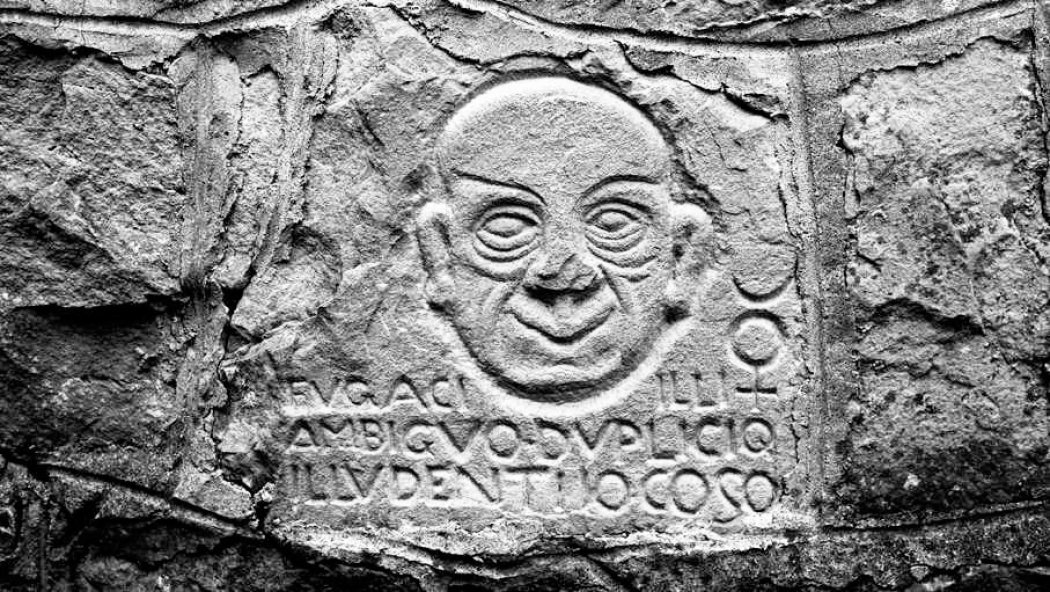

The expectation that danger and protection might exist in equal proportions is unreal. Safety precautions do not adjust dynamically when danger turns into greater danger, or when calculation errors wrongly indicate the limits of tolerance – indeed, this is how they can actually increase danger. (Spontaneous rescue from danger is just as conceivable as a spontaneous demise in the midst of safety.) What needs to be rescued could in fact be protected by avoiding any predictable contact; but this would of course be contrary to natural human behaviour. Catastrophically human is the opposite extreme – replacing any knowledge of danger with complete security by means of reinforcement. This exaggeration challenges the trickster who embodies the unpredictable on the basis of everything. Surely there has to be someone who makes the gaps between the differences of meaning flexible and who creatively uses the slits and cracks between wish and reality.

→ Listen up, what´s coming in from outside.

III

Our trust in facades is an unjustified preconception, as inherited intuitive evaluations of safety and security no longer conform to contemporary construction practices. In contrast to the structure of a building, its exterior surface received more attention in the 20th century. The facade distanced itself from the building. Where in the past there were cracks both inside and out, today the building’s substance is concealed so that it quietly survives behind the cover of its good reputation. One’s mistrust of the structural safety should actually increase when the foundation of intuitive reasons to assess the situation are neglected; however, giving the substance a veneer is generally welcomed instead. The ambient noise of all pedestrian areas is a gnawing away at the immaculate order of facades. The crack between core and shell is a no man’s land. This interspace is a pure void with nothing but an interspace. The breeding ground of furry, photophobic diagonal struts. New kinds of ghost towns; here in the void is their breeding ground.

Thus, the emergency stabilisation presented is questioned – and, consequently, its room for manoeuvre as well. For whether the support of the facade will actually reach the core of the structure is unsure.

IV

In 2011, the year when this project was realised, questions were raised regarding economic stability in the sovereign debt crisis. There were further discussions against this very backgroup – although, in principle, it was a question about the failing of the very same security precautions as in 1912.

Experiences do not justify reliable predictions (David Hume): this is a dilemma because the idea of a future can only be imagined out of previous knowledge, which every form of trust depends on and which directs all subsequent action. Crises in security are first and foremost crises of trust in the future; they increase when mistakes in the heuristic fundamentals of decision-making become apparent. The two last financial crises were also the result of a lack of confidence: 2008 – a trust in increasing real estate values (in order to secure added value after taking up a mortgage); 2011 – a trust in the stability of European government bonds (for the equivalent of which the banks had no real reserves). The 2008 financial crisis was partly the result of an attempt to outsmart the fragile causal link between individual processes. In order to attract the notoriously risk-shy buyers’ interest, derivatives were introduced; this resulted in such a tense interconnection of real estate and financial markets (mortgage-guaranteed loans) that it became impossible to disassociate the two. A total write-off was the outcome. Feeling safe and secure in today’s financial markets means to expect the worst.

The billions of euros negotiated as bailout in order to rescue the European currency primarily helped sustain the banks through the provision of guarantees for devalued government bonds. This, however, had little impact on stabilising the markets. The facade of the euro distanced itself from the real economies of the different European states, covering up their structural differences. Their budgets were consumed internally by a disproportionate debt growth. The holes in national budgets are like all holes: people are only interested in the depth, not the edge of the holes. They are the equivalent of the speculative intentions of the capital markets, myopically aiming for high profit margins with little regard for the surrounding environment.

Somewhere down the road, emergency measures will end up supporting the whole system. The act of hedging will become a facade in front of a facade. The substantial bulk of liabilities incurred cannot be balanced out in centuries to come.